Why Your First $1,000 Should Be Invested in “S&Me” Instead of the S&P 500

Investing your first $1,000 can feel overwhelming. The stock market dazzles with promises of high returns, and most financial experts automatically point to the S&P 500. Yet, for your very first investment, there is a compelling argument for a different approach: investing in yourself, which we will call “S&Me.” This concept focuses on personal growth, skills, health, and relationships, promising returns that no market index can guarantee.

Understanding the S&P 500: Traditional Wisdom in Investing

The S&P 500 is widely celebrated as the cornerstone of beginner investing. It represents the 500 largest publicly traded companies in the U.S., providing a snapshot of the broader market. Historically, it has returned about 10% annually, making it a reliable, passive investment choice.

What the S&P 500 Represents

When you buy an S&P 500 index fund, you are essentially buying fractional ownership in 500 companies, including Apple, Microsoft, and Amazon. This approach spreads risk and exposes you to the growth of multiple industries simultaneously.

The Appeal of S&P 500 for Beginners

The S&P 500 appeals because it is low-maintenance. Once you invest, the index automatically tracks the market, and you can sit back as your money grows over decades. Many financial planners advise this as the foundation of retirement planning because of its simplicity and historical track record.

The Concept of “S&Me”: Investing in Yourself

Your first $1,000 does not have to go into the market. Imagine using that money to grow your skills, expand your network, or improve your health. This is the philosophy of S&Me investing.

What “S&Me” Actually Means

“S&Me” is a mindset. You are the most important asset you own. This could mean:

- Learning a new skill that boosts your earning potential

- Attending workshops or certifications that accelerate your career

- Prioritizing mental and physical health to enhance productivity

- Building meaningful relationships or mentorship networks

Compounding Your Personal Growth

Just like money in an index fund, investments in yourself compound, but even faster. Skills, confidence, and networks amplify over time, often producing opportunities that far exceed standard financial returns.

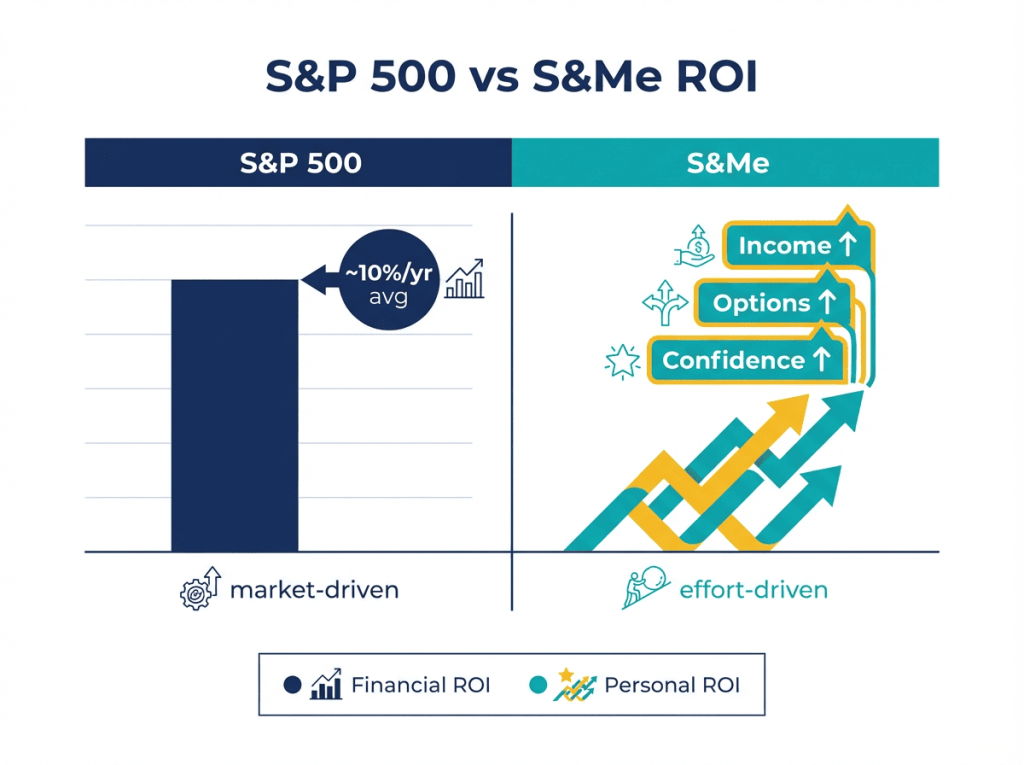

Comparing ROI: S&P 500 vs “S&Me”

How do the returns of self-investment compare to the S&P 500?

Traditional Financial ROI

- Average S&P 500 return: approximately 10% annually

- Dividends reinvested: compounding wealth

- Liquidity: funds can be sold at market value

Personal ROI from “S&Me”

- Career advancement leading to higher income

- Ability to start a profitable side hustle

- Enhanced decision-making, productivity, and mental resilience

- Benefits that persist a lifetime, unlike temporary market gains

Psychological Advantages of Investing in Yourself

Investing in S&Me is not just financial; it is mental. Studies show that self-investment improves confidence, motivation, and risk management skills. Unlike the stock market, where external events dictate returns, your personal growth is controllable.

Motivation and Momentum

Each small success, such as completing a course or networking effectively, builds momentum. That momentum fuels bigger risks and higher rewards, both financially and personally.

Risk Management and Control

While the market fluctuates, your personal investment is predictable. You control your effort, your time, and your environment, which translates into more stable, reliable growth.

Practical Ways to Invest in “S&Me”

Education and Skill Development

Spend money on:

- Online courses (Udemy, Coursera)

- Professional certifications (PMP, AWS, Google Analytics)

- Workshops or bootcamps

Health and Fitness

Invest in:

- Gym memberships or home fitness equipment

- Nutritional coaching or wellness programs

- Mental health support (therapy, meditation apps)

Networking and Mentorship

Invest in relationships:

- Attend conferences and seminars

- Join professional associations

- Hire a mentor or coach

How to Decide Between S&P 500 and “S&Me”

If you are unsure whether to invest in the market or yourself, consider:

Short-Term vs Long-Term Goals

- Need immediate career or financial leverage? S&Me is better

- Planning for retirement decades away? S&P 500 makes sense

Risk Tolerance and Comfort

- Market volatility makes some people anxious

- Personal growth investments are more controllable and measurable

Case Studies: Success Stories of “S&Me” Investors

- Sara, 25: Spent $1,000 on coding courses, launched a freelance career, and tripled her income within a year

- Tom, 30: Invested in fitness and nutrition, improved focus, and secured a promotion and bonus

- Lila, 22: Joined a mentorship program, built a startup network, and raised seed funding

Avoiding Common Pitfalls

- Avoid spreading yourself too thin across too many courses

- Do not expect instant financial gains; personal ROI compounds over time

- Stay disciplined: focus on high-leverage growth opportunities

Conclusion

While the S&P 500 is a reliable, long-term investment tool, your first $1,000 may serve you better in S&Me, investing in your skills, health, and relationships. This approach compounds personal and professional growth, often creating opportunities far beyond traditional stock market gains. Start with yourself, and financial returns will follow.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always consult a qualified professional before making financial decisions.

About Ethan Walker

Written by Ethan Walker, a personal finance writer focused on smart investing and self-growth strategies.

View all posts by Ethan Walker