What Is Day Trading, and How Does It Work for Beginners?

You have probably seen those flashy social media posts. Someone sitting on a beach with a laptop, claiming they made $5,000 before breakfast. Or maybe you have heard stories about regular people quitting their 9-to-5 jobs to trade stocks from home.

And now you are curious. Maybe even excited.

But here is the truth most people do not tell you upfront. Day trading is not a get-rich-quick scheme. It is a skill. A craft. And like any craft worth mastering, it takes time, discipline, and patience.

This guide is not here to sell you a dream or scare you away. It is here to give you a clear, honest explanation of what day trading actually is, how it works, and whether it may be the right path for you.

So grab your coffee, settle in, and let us break it all down step by step.

What Exactly Is Day Trading?

Day trading is the practice of buying and selling financial instruments within the same trading day. By the time the market closes, all positions are closed. There is no overnight holding and no waking up to surprise price gaps.

Think of it this way. You are renting stocks, not buying a house. You enter a trade and exit it the same day. Sometimes that happens in minutes. Sometimes it takes hours. But it always happens before the closing bell.

The goal is to profit from small price movements. These moves might seem tiny, such as a stock moving fifty cents or one dollar. But when you are trading hundreds or thousands of shares, those movements add up quickly.

Day traders typically focus on:

- Stocks, which are the most popular in the US market

- Options, which carry higher risk and higher reward

- Forex, or currency trading

- Futures, which are contracts tied to commodities or indexes

- Cryptocurrency, which trades around the clock and is highly volatile

Each market behaves differently, but the core idea stays the same. Get in, capture the move, and get out.

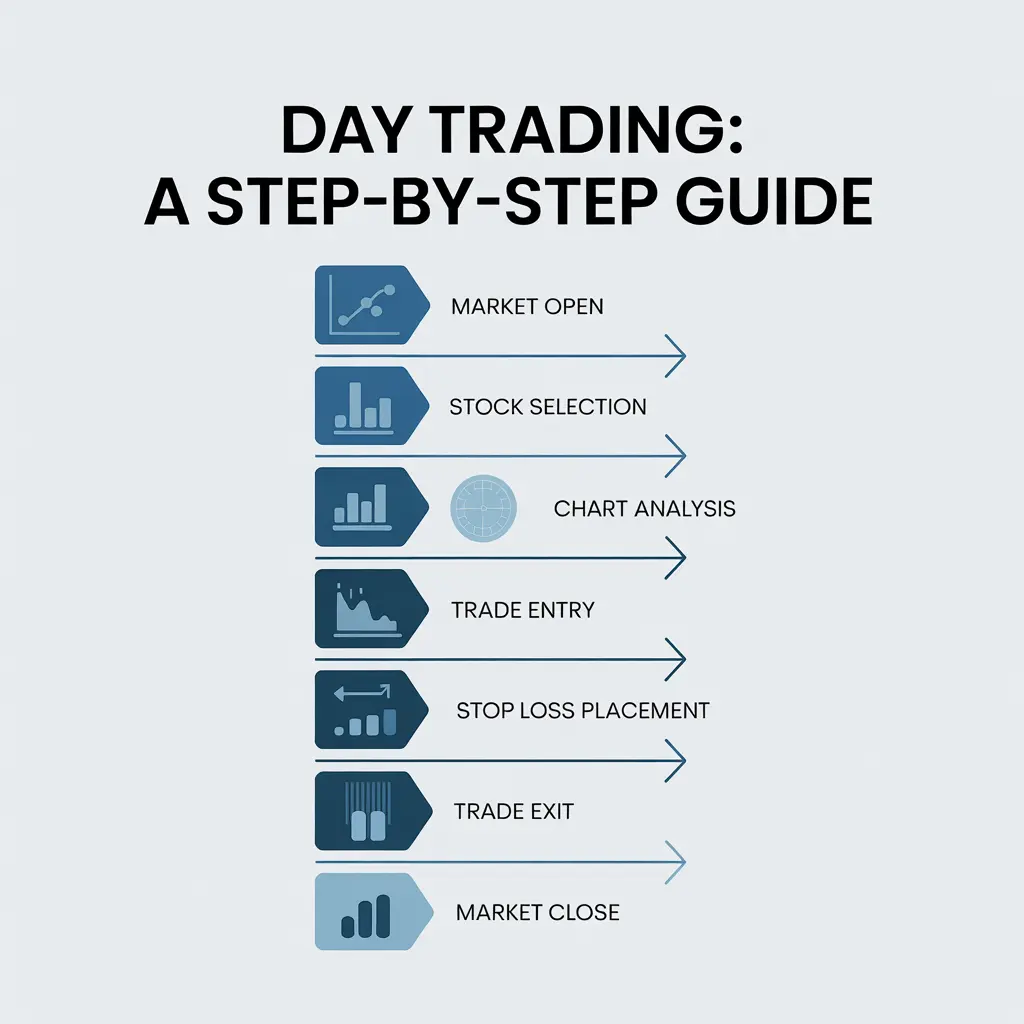

How Does Day Trading Actually Work?

Before risking a single dollar, you need to understand how the process works from start to finish.

Step 1: Setting Up Your Trading Account

You need a brokerage account to day trade. In the United States, common platforms include Charles Schwab, Fidelity, E*TRADE, Webull, and Robinhood.

One critical rule you must understand is the Pattern Day Trader rule. If you make four or more day trades within five business days using a margin account, you must maintain at least $25,000 in your account.

If you do not have $25,000, you still have options:

- Use a cash account and follow settlement rules

- Trade forex or crypto, which are not subject to the rule

- Limit yourself to three day trades per week

Understanding this rule upfront prevents costly mistakes later.

Step 2: Choosing What to Trade

Not every stock is suitable for day trading. The best candidates are:

- Volatile, meaning they move enough to create opportunity

- Liquid, with high volume so trades fill quickly

- News-driven, such as earnings releases or major announcements

Most traders build a watchlist each morning using scanners to find stocks with unusual volume or price movement. Tools like Finviz, Trade Ideas, and Benzinga are commonly used for this purpose.

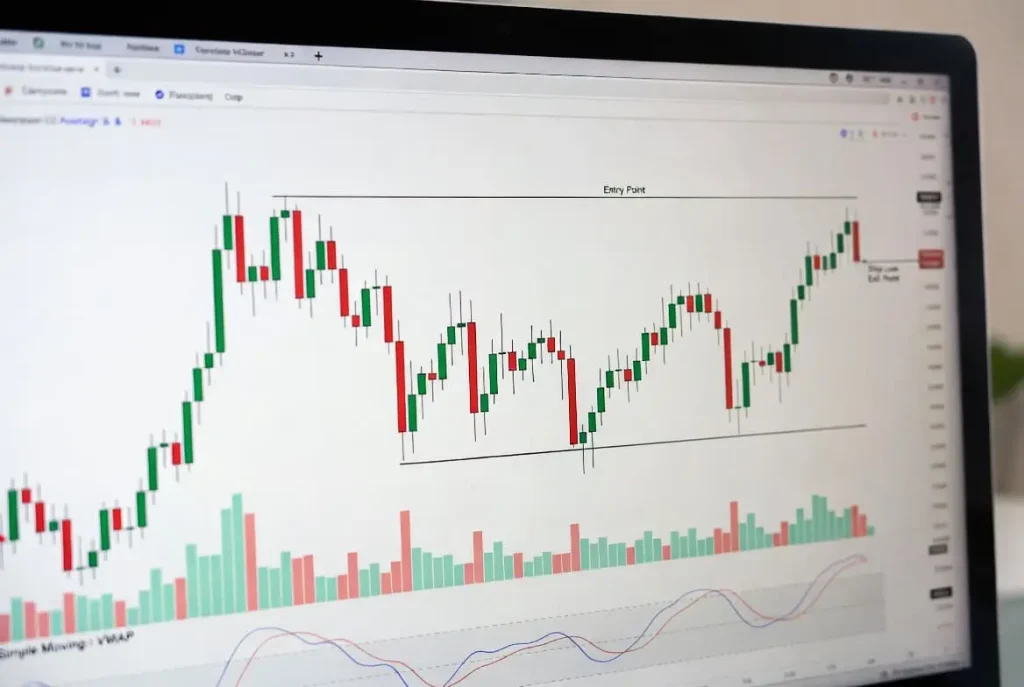

Step 3: Reading the Charts

Day traders rely heavily on technical analysis rather than company fundamentals.

Common tools include:

- Candlestick charts to visualize price movement

- Moving averages to identify trends

- Volume indicators to confirm strength

- Support and resistance levels to anticipate price reactions

- VWAP, which is widely used for intraday trading

Learning to read charts takes time. For most beginners, it takes months of consistent practice.

Step 4: Executing the Trade

Once you identify a setup, execution matters.

You will use different order types:

- Market orders to buy or sell immediately

- Limit orders to enter at a specific price

- Stop-loss orders to automatically exit losing trades

The stop loss is non-negotiable. It protects your capital and prevents one bad trade from destroying your account.

Step 5: Managing the Position

After entering a trade, emotions come into play. Should you take profit now or hold longer? Should you cut the loss early?

This is where discipline matters most. Emotional decisions ruin more traders than bad strategies.

Successful traders follow a written plan and stick to it.

Step 6: Closing Positions Before the Market Closes

Day traders close all positions before the market closes at 4:00 PM Eastern Time. Holding overnight exposes you to news, earnings, and global events you cannot control.

Each trading day starts fresh.

What Equipment Do You Need to Day Trade?

You do not need a Wall Street setup, but reliability matters.

Minimum requirements:

- Fast and stable internet connection

- A reliable computer or laptop

- One or two monitors

- A dependable trading platform

Extras:

- Backup internet connection

- Multiple monitors

- A quiet workspace

Your internet connection is your lifeline. A dropped connection during a trade can be costly.

How Much Money Can You Make Day Trading?

This is the question everyone asks.

Here is the honest answer. Most day traders lose money. Studies suggest that 70 to 90 percent of traders do not achieve long-term profitability.

Those who succeed often fall into these ranges:

- Beginners, often losing money or breaking even

- Intermediate traders, earning modest and inconsistent income

- Experienced traders, earning several thousand dollars per month

- Elite traders, earning six figures annually

Your results depend on:

- Account size

- Skill level

- Risk management

- Market conditions

- Consistency

A realistic goal for beginners is one to three percent monthly growth. That may sound small, but it compounds over time.

Risks of Day Trading You Must Understand

Financial Risk

You can lose money quickly. There are no guarantees.

Psychological Stress

Constant decision-making can cause anxiety and burnout.

Time Commitment

Successful traders spend hours preparing, trading, and reviewing.

Overtrading

More trades often mean more mistakes.

Lifestyle Impact

Your schedule revolves around market hours.

Understanding these risks before starting is critical.

Beginner Day Trading Strategies

Momentum Trading

Trading stocks that are moving strongly in one direction.

Scalping

Making many small trades for tiny profits.

Reversal Trading

Trading against extreme moves, expecting a pullback.

Each strategy requires practice and risk control.

Tips for New Day Traders

- Start with paper trading

- Master one strategy

- Keep a trading journal

- Risk only one to two percent per trade

- Accept losses as part of learning

- Avoid trading the first fifteen minutes of the market

- Stay humble and disciplined

Frequently Asked Questions

Is day trading legal in the United States?

Yes. Day trading is legal in the United States, but traders must follow regulations such as the Pattern Day Trader rule when using margin accounts.

Can beginners really make money day trading?

Some beginners eventually succeed, but most traders lose money early on. Consistent profitability usually requires one to two years of practice, discipline, and strong risk management.

How much money do I need to start day trading?

You can technically start with a small amount, but active stock day trading with margin requires at least $25,000 due to regulations. Cash accounts, forex, or crypto may allow smaller balances.

What is the biggest risk in day trading?

The biggest risk is poor risk management. Emotional trading, overtrading, and failing to use stop losses can quickly lead to large losses.

How many hours a day do day traders work?

Most successful day traders spend several hours preparing before the market opens, trade during market hours, and review trades afterward.

Is day trading better than long-term investing?

Day trading and long-term investing serve different goals. Day trading requires active involvement and higher risk, while long-term investing is generally more passive and stable.

Final Thoughts

Day trading is not a shortcut to wealth. It is a demanding skill that rewards patience, discipline, and risk control.

Those who succeed study relentlessly, manage risk carefully, and focus on survival before profits.

Start small. Protect your capital. Learn continuously.

The goal is not to get rich fast. The goal is to still be trading a year from now.

That is where real progress begins.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Investing and trading involve risk, and past performance does not guarantee future results.

Related Posts

No related posts found.